Fibonacci & Elliott Wave

After two chapters of learning pattern after pattern, we now know what patterns we can expect to see in the movements in a direction of the larger trend and in the movements when the market is moving against the larger trend. That’s all good in theory, but that can’t make us money; to build a trading strategy, we need to know exactly where and when we need to buy, and that’s why we are going to cover Fibonacci in this chapter.

To successfully use Fibonacci in our platform, we need to learn and understand two simple tools that I know for sure every platform has: Fibonacci Retracement and Fibonacci Expansion (if your platform doesn’t have these two tools, you are using the wrong broker).

Fibonacci Retracement Tool

Fibonacci Retracement tool is going to help us to predict potential endings of corrective patterns, so this tool will be helpful for waves 2, 4, B, X. Using this tool requires from you to select two points, starting and ending points, and you are always going to use the starting and ending points of the previous trend wave / motive wave as your points for this tool.

Example: If you want to project the wave 2 targets, you are going to draw Fibonacci level from start to end of the previous motive wave 1.

Fibonacci Expansion Tool

Fibonacci Expansion tool is going to help us to predict potential endings of trend waves, so this tool will be helpful for waves 3, 5, C . This tool requires from you to select three points, and you are going to draw fibs from start to finish of the previous trend wave and then project from the pullback.

Example: If you want to project the wave 3 targets, you are going to draw Fibonacci level from start to end of previous motive wave 1 and then project it from the ending point of wave 2.

Fibonacci & Motive Phase

Wave 2 Fibonacci Targets

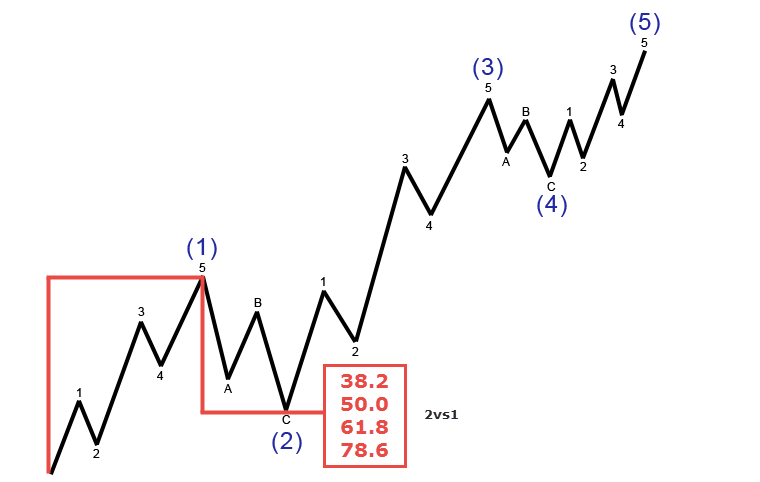

Wave two is the first pattern that we can project with the help of Fibonacci. To project the potential ending point of wave two, we are going to use Fibonacci Retracement Tool, drawing Fibonacci levels from starting to ending points of wave 1.

Fibonacci Levels For Wave 2

– 38.2% of wave 1 (minimum expected level)

– 50.0% of wave 1 (first ideal level)

– 61.8% of wave 1 (second ideal level)

– 78.6% of wave 1 (maximum expected level)

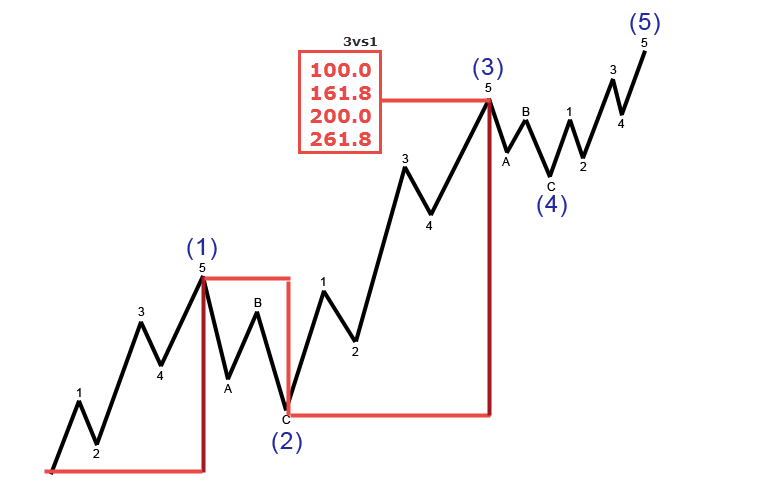

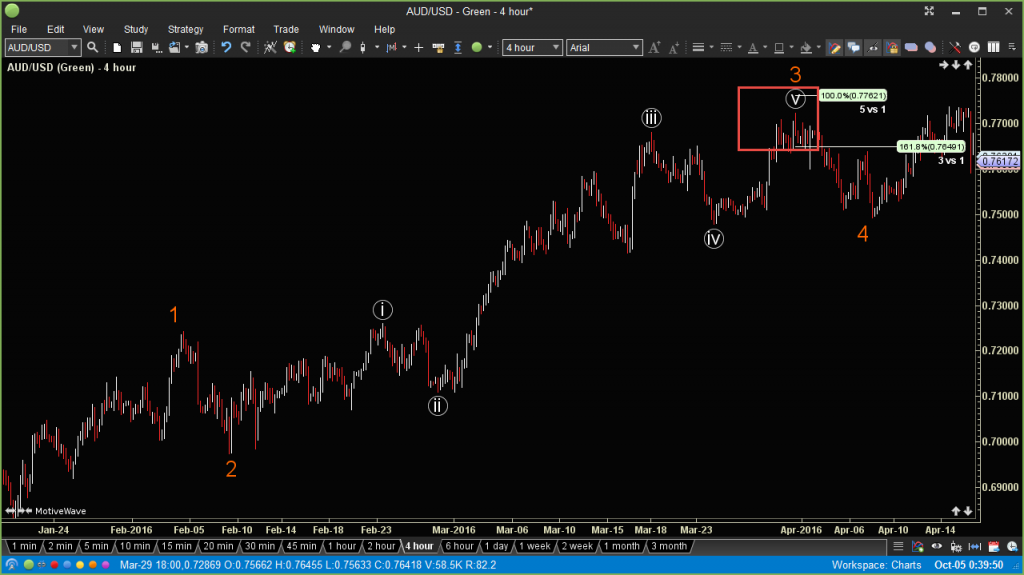

Wave 3 Fibonacci Targets

Wave 3 is our money wave, and from basic guideline, we know that the third wave is usually going to be the strongest wave, so we are going to compare wave 3 against wave 1. To get the best level, we are going to use Fibonacci Expansion Tool, drawing Fibonacci levels from start to end of wave 1 and projecting from the end of wave 2.

Fibonacci Levels for Wave 3

– 100.0% of wave 1 (minimum expected level)

– 161.8% of wave 1 (ideal expected level)

– 200.0% of wave 1 (usual level in extended waves)

– 261.8% of wave 1 (other useful level for extended waves)

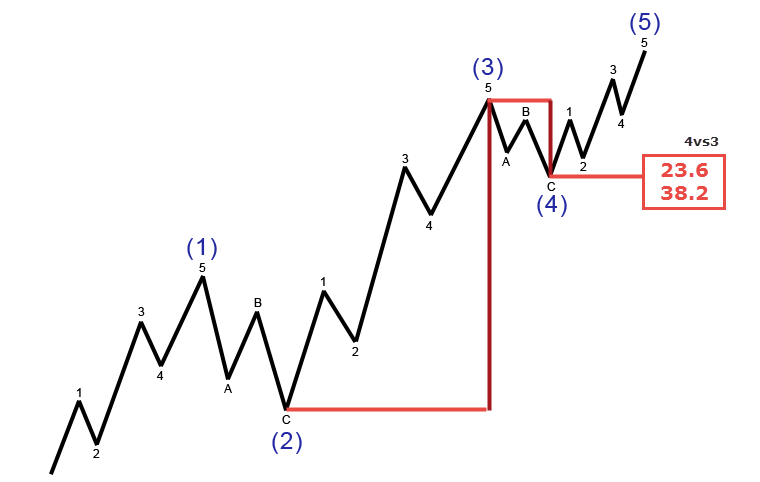

Wave 4 Fibonacci Targets

Wave 4 is the second and final pullback in motive phase, and this wave comes after 3 completed waves, and that’s why we have a few different ways to project this wave.

The first (recommended) way will be to compare wave 4 against the previous wave 3. We are going to use Fibonacci Retracement Tool, drawing Fibonacci levels from start to end of wave 3.

The second way will be to compare wave 4 with wave 2 — according to a lot of study, wave 4 has a good chance of being equal in size to wave 2. To project that line, you can draw Fibonacci levels from start to end of wave 2 and, after that, move that fib to end of wave 3 (you can also just draw a line and copy that).

Fibonacci Levels For Wave 4

– 23.6% of wave 3 (minimum expected level)

– 38.2% of wave 3 (ideal expected level)

– 50.0% of wave 3 (final expected level)

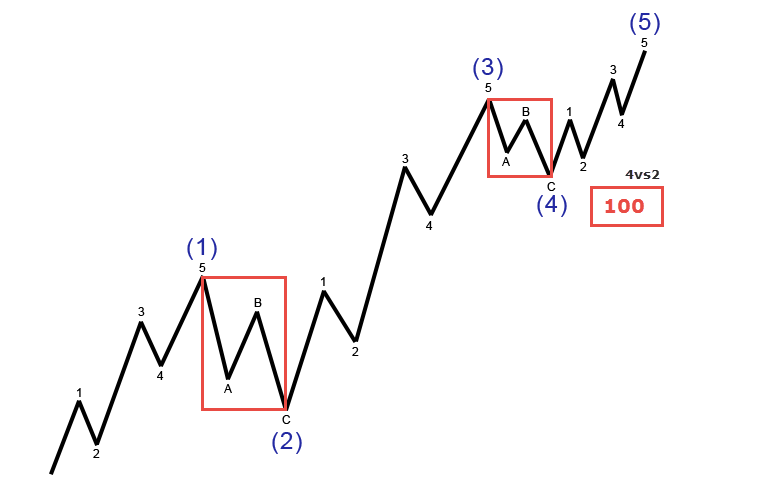

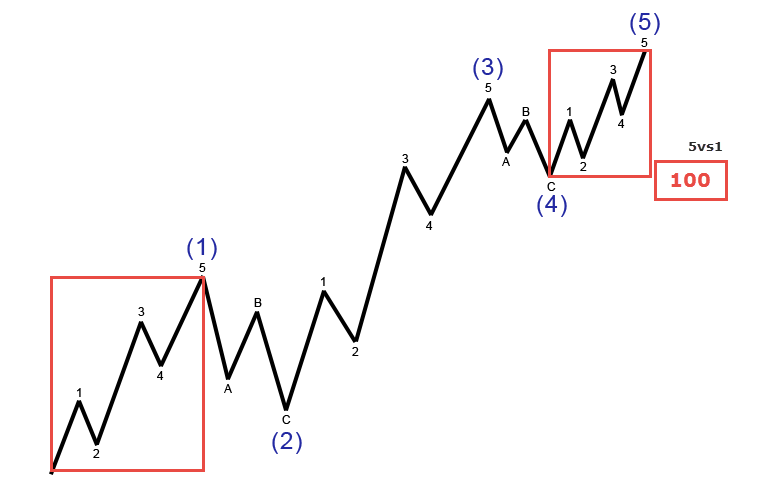

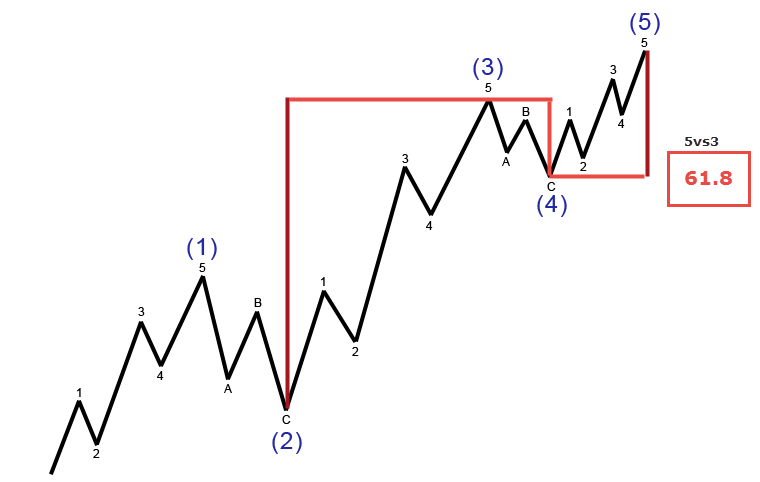

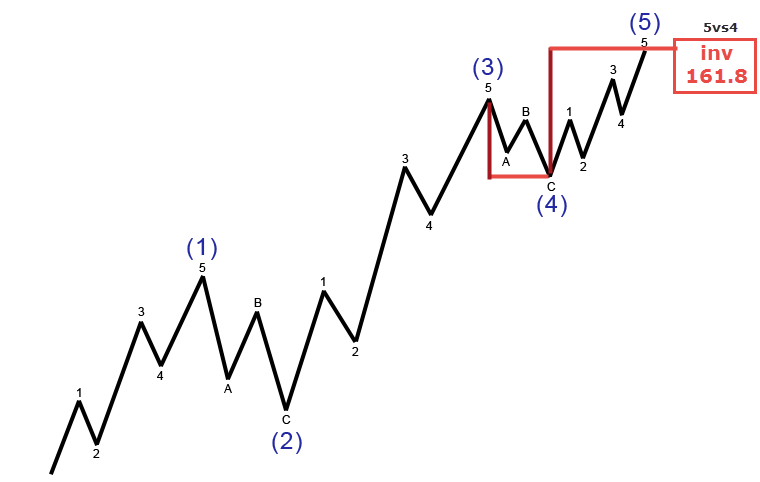

Wave 5 Fibonacci Targets

Wave 5 is the final wave from motive phase that we need to project. This wave is also going to have a few different ways for how you can find potential ending points with Fibonacci.

The first way will be to compare wave 5 with the previous wave 1. We are going to use Fibonacci Retracement Tool, drawing Fibonacci levels from start to end of wave 1 and, after that, we are going to move that fib to the end of wave 4.

The second way will be to compare wave 5 with wave 3, and we are going to use Fibonacci Expansion and draw Fibonacci levels from start to end of wave 3 and project from the end of wave 4.

The third way will be to compare wave 5 with wave 4, and for this method we are going to use Fibonacci Retracement Tool and draw a line from start to end of wave 4.

Fibonacci Levels for Wave 5

– 100% of wave 1 (5vs1)

– 61.8% of wave 3 (5vs3)

– Inverse 161.8% of wave 3 (5vs4)

Fibonacci & Corrective Phase

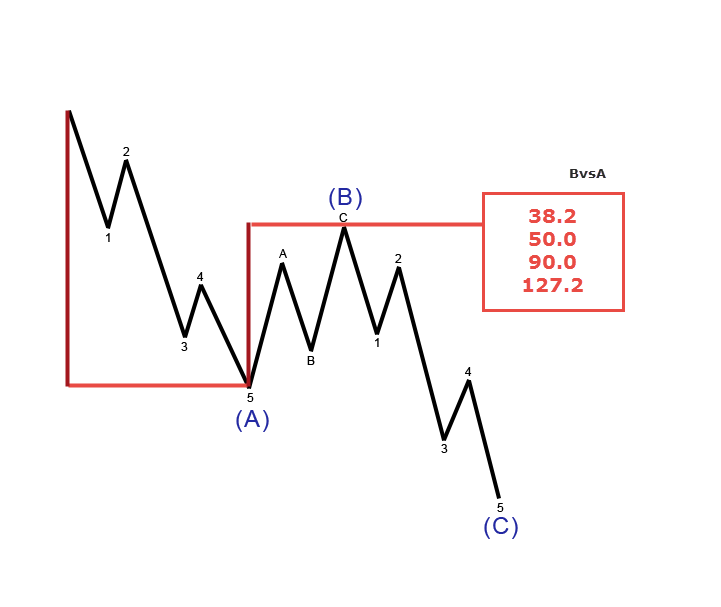

Wave B Fibonacci Targets

Just like in motive phase, it’s hard to project wave 1, and the same goes with wave A. We are going to start Wave B. We are going to use Fibonacci Retracement tool and draw Fibonacci levels from start to end of wave A.

Fibonacci Levels for Wave B

– 38.2% of wave A (Minimum Expected Level)

– 50.0% of wave A (Ideal Level For Zig Zag)

– 90.0% of wave A (Minimum Level for FLAT)

– Inverse 127.2% of wave A (Ideal Level for Expanding and Running FLAT)

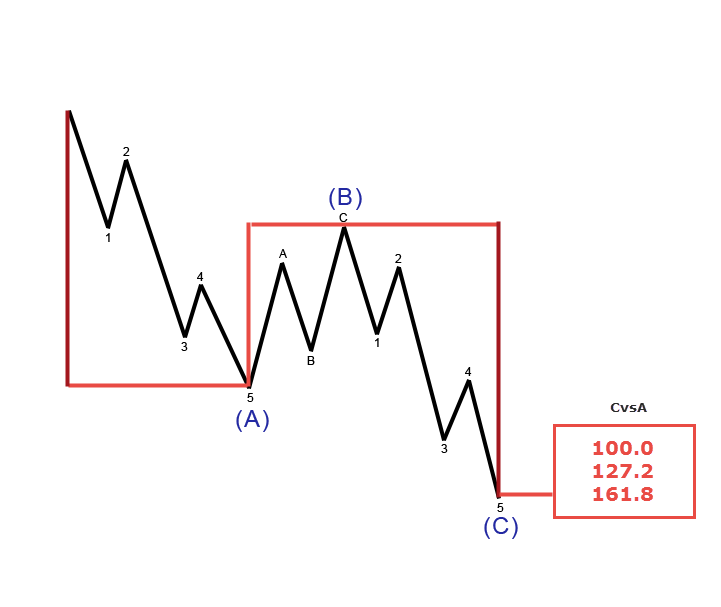

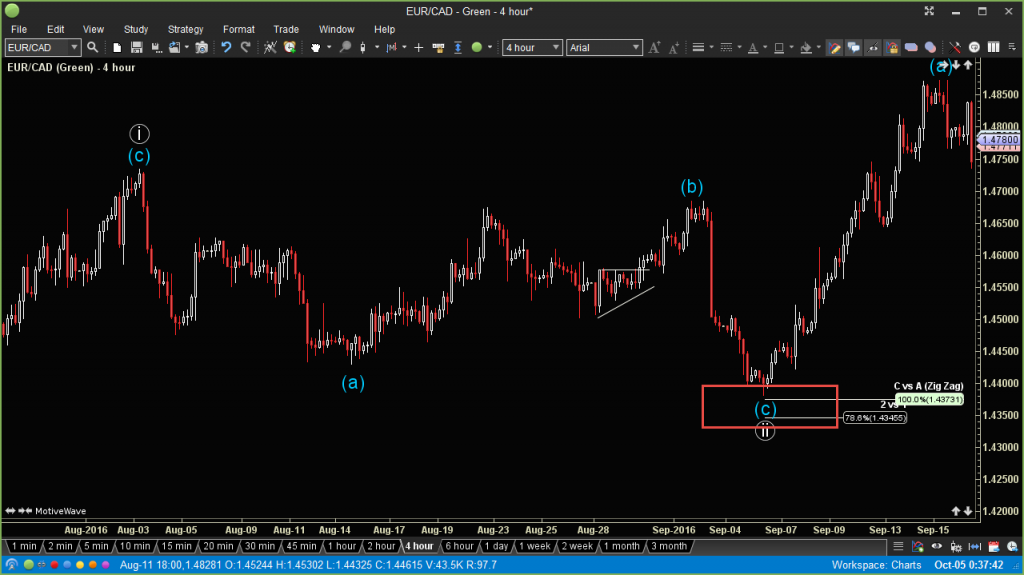

Wave C Fibonacci Targets

Wave C is the final leg we can project from the three leg correction. To get the best level, we are going to use Fibonacci Expansion Tool, drawing Fibonacci levels from start to end of wave A and projecting from the end of wave B.

Fibonacci Levels For Wave C

– 100.0% of wave A (First Ideal Level for Zig Zag)

– 127.2% of wave A (Second Level for Zig Zag)

– 161.8% of wave A (Ideal Level for FLAT)

Triangle Fibonacci Targets

Triangle pattern have 5 waves, and we know that each leg is going to be smaller than the previous one. Projecting wave B will be the same as we already mentioned: we are going to look for 61.8% of wave A as the ideal level. For all other waves, we are going to use Fibonacci Expansion tool and project the 61.8% of the previous wave that was trading in the same direction.

Wave C – drawing from start to end of wave A and projecting from end of wave B

Wave D – drawing from start to end of wave B and projecting from end of wave C

Wave E – drawing from start to end of wave C and projecting from end of wave D

Every time we are going to look for 61.8% ext level as ideal target.

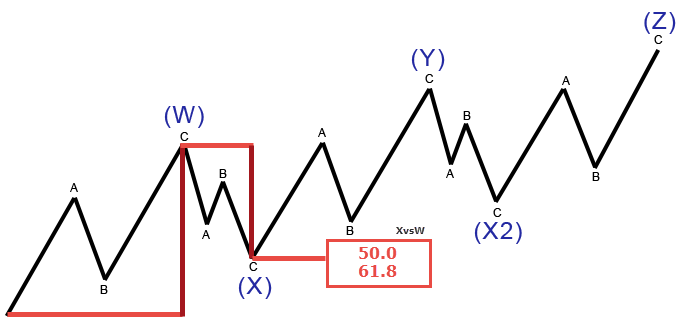

Wave X Fibonacci Targets

Wave X is the first wave from advanced corrections we can project, and the process will be exactly the same as what we did for wave B. We are going to use Fibonacci Retracement tool and draw Fibonacci levels from start to end of wave W.

Fibonacci Levels For Wave X

– 50.0% of wave W (First Expected Level)

– 61.8.0% of wave W (Second Expected Level)

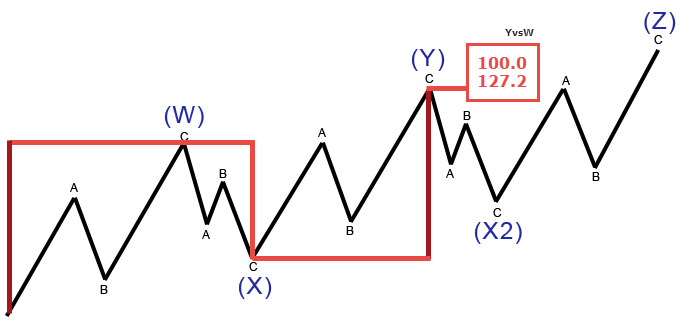

Wave Y Fibonacci Targets

Wave Y is the final leg in double three corrections and the third leg in triple three pattern. The process how to get the best levels for potential ending point in wave Y will be exactly the same for both patterns. We are going to use Fibonacci Expansion Tool, drawing Fibonacci levels from start to end of wave W and projecting from the end of wave X.

Fibonacci Levels for Wave Y

– 100.0% of wave W (First Ideal Level)

– 127.2% of wave W (Second Level)

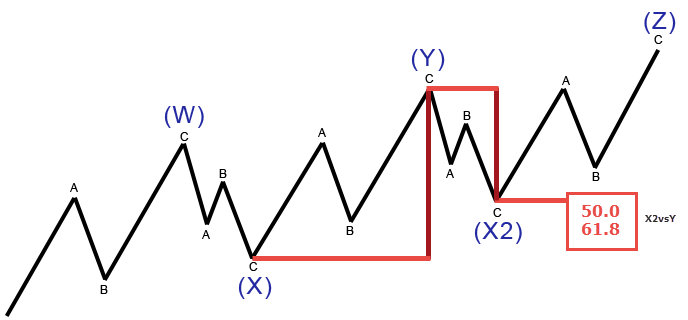

Wave X2 Fibonacci Targets

Wave X2 is the fourth wave in triple three, and there are few options for how to project this correction.

The first way is comparing wave x2 with wave Y. For this approach, we are going to use Fibonacci Retracement tool and draw Fibonacci levels from start to end of wave Y.

The second way is comparing x2 to x1. For this approach, we need to draw Fibonacci Retracement and draw Fibonacci levels from start to end of wave X1, and after that we can move that fib to the ending point of wave Y.

Fibonacci Levels For Wave X2

– 50.0% of wave Y (First Expected Level)

– 61.8% of wave Y (Second Expected Level)

– 100.-% of wave X1

– 127.2% of wave X1

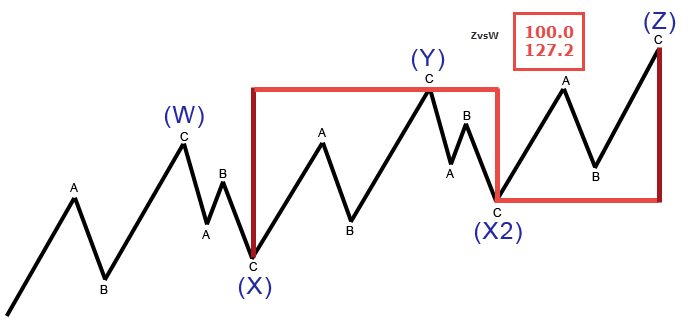

Wave Z Fibonacci Targets

Wave Z is the final leg in the triple three corrections pattern. We are going to use Fibonacci Expansion Tool, drawing Fibonacci levels from start to end of wave Y and projecting from the end of wave X2.

Fibonacci Levels For Wave C

– 100.0% of wave Y (First Ideal Level)

– 127.2% of wave Y (Second Level)

Fibonacci Tricks Tips

Advanced Fibonacci Approach

We know what standard levels we can watch, but we also know that we are going to have an exact number of sub-waves in each wave that we are going to measure. To get the best results, you should start combining Fibonacci targets for larger and smaller waves.

If you want to get the best idea of where corrective waves, like waves 2, 4, B, should end, you can search for matching fib levels between the larger wave and smaller C sub-wave.

Example of How to Find Multiple Fib Targets for Wave 2

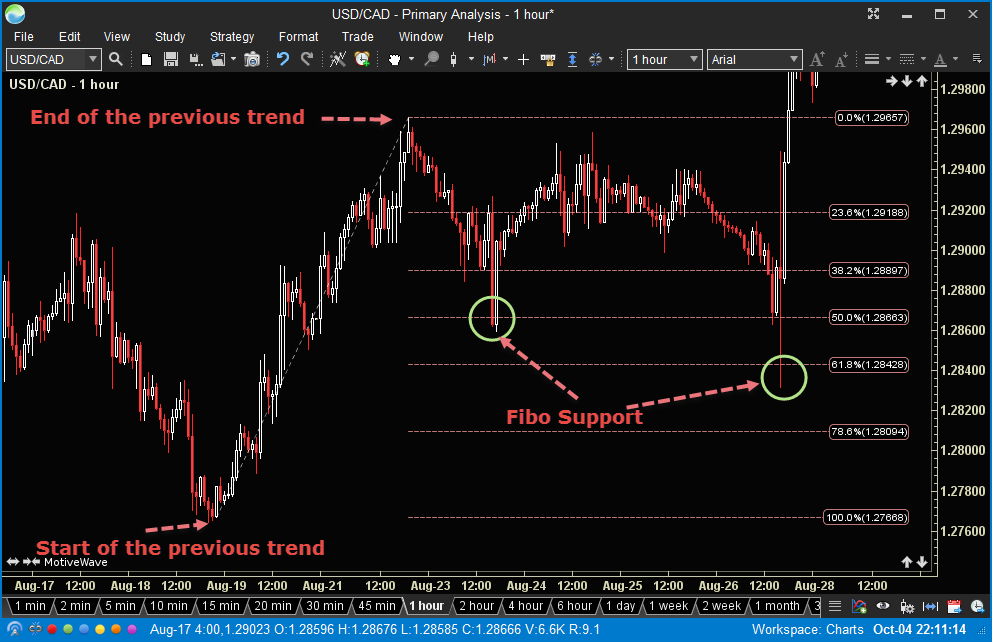

As you can see on the chart, we first projected wave 2 with Fibonacci Retracement Tool, and we drew it from start to end of wave 1. After we completed smaller wave B of 2, we can add Fibonacci expansion and project 100-127.2% of wave A. Now we can see that 50% comes close to 100% expansion, and we can call this zone (marked green on picture) Fibonacci support zone.

We can do exactly the same thing for projecting motive waves, and we can try to match the larger levels with smaller sub-wave 5.

Example of How to Find Multiple Fib Targets for Wave 3

On the image above, we can see that we are matching 161.8% extension of wave 1 with 100% extension of the smaller 5=1 target. The zone between these two levels in our case will be a good Fibonacci resistance zone.

What Have We Learned in This Chapter…

This chapter was all about numbers. Fibonacci is a big subject and I could easily write an entire book just on this… But you really don’t need to know anything else to become a perfect trader.

Before you move to the next chapter, where we are going to start building the trading strategy that we are going to use, I want you to go and practice drawing Fibonacci levels.